The US data center market – a shift towards independent Cost and Schedule Management

The data center market is ever-evolving, as providers look to better align their supply with market demand.

This necessitates the building of data centers faster and more cost effectively than ever before, as discussed in our ‘Bigger, faster, cheaper’ article.

US data center market overview

A few quick facts to put the US data center sector into context:

- The data center construction market in the US is forecast to grow at a Compound Annual Growth Rate (CAGR) of 6.34 percent during the period 2017-2021

- Although consolidation is a major challenge for the sector in the US, the market is still expected to generate revenue of approximately $13 billion between 2016 and 2021

- Hubs like Ashburn, Virginia, dubbed “Data Center Alley”, are home to almost every major US data center provider, and could double from the current 10 million sq.ft. of data center footprint area to as much as 20 million sq.ft. by 2020

- The battle between providers is often referred to as “The Cloud Wars”, with the two biggest players at present being Amazon (Amazon Web Services) and Microsoft (MSFT)

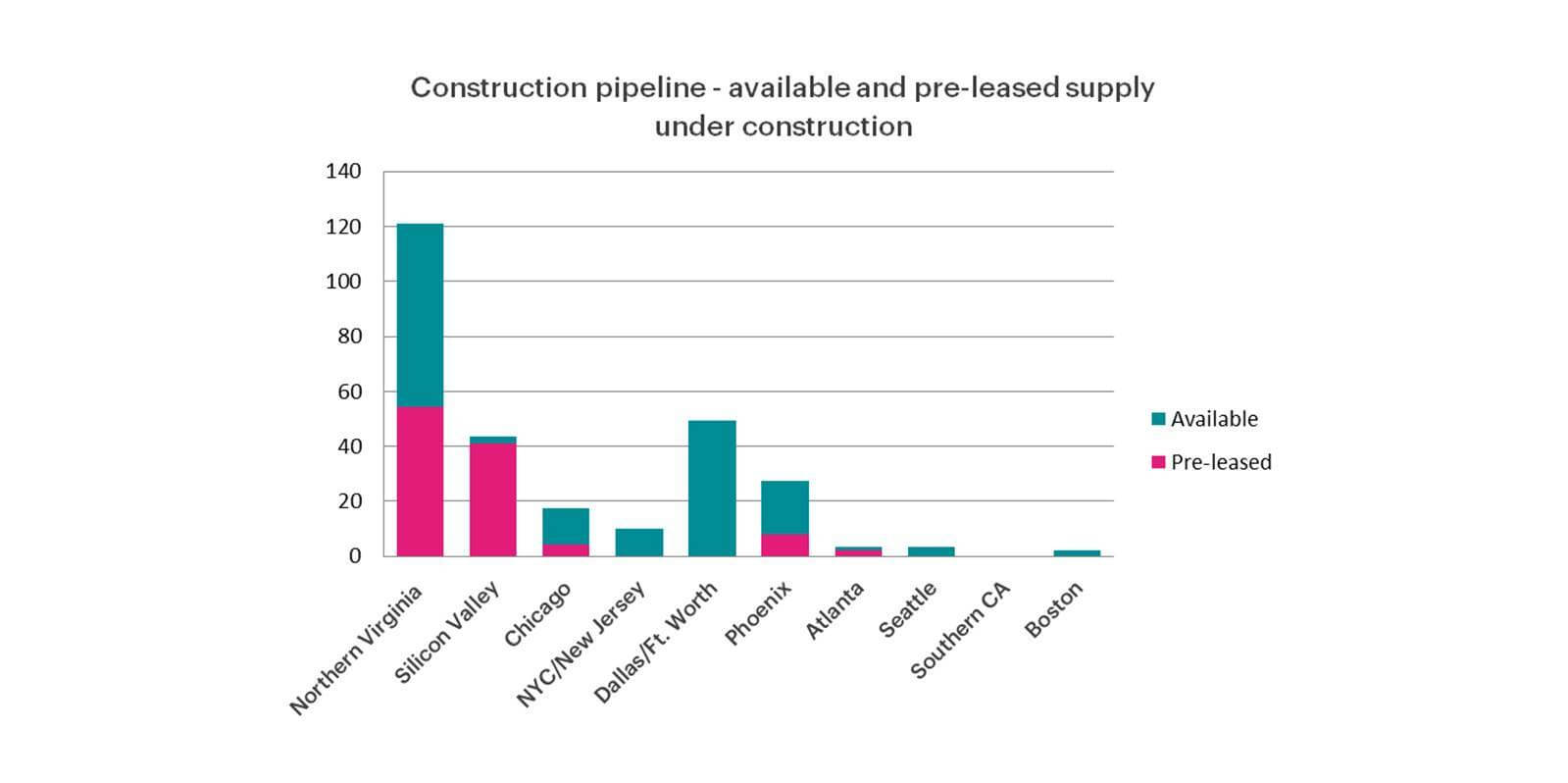

- At the end of 2016, there was 271MW under construction, of which more than 160 MW was being delivered on a speculative basis

US delivery model

The US market has long asked the General Contractor (GC) to look after their schedule and cost management. Traditionally, a GC would be brought in and provided with a schematic design (SD), and asked to provide an estimate and schedule to match. The client may have stipulated a completion date, but, for the most part, the GC’s information at SD stage would become the baseline schedule and estimate. The client’s on-site Project Managers would then run the project from that point, with the GC’s on-site staff providing the necessary project support. With this method achieving completed data centers, many stakeholders initially asked, “What is the benefit of independent Schedule and Cost Management?”

Schemes such as shared savings were introduced to address the issue of GCs dictating and controlling their own budget, it appears to have had limited success. In fact, it can encourage the padding of the initial budgets in order to ensure shared savings are achieved and so clients had to look outside of the traditional delivery model to maintain competitiveness in cost of construction.

Independent Cost and Schedule Management - why?

Through the extensive experience that we have gained as Quantity Surveyors/Cost Managers in other markets, as well as our in-depth knowledge of the US market, it is evident that the traditional cost model in the US is undergoing a seismic shift. This shift can largely be attributed to two key factors.

Firstly, the major providers in the market are large multinationals with data centers across the world. Cost Management, Schedule Management and integrated Project Controls are commonplace in many of those locations globally, and par for the course in the construction process. It became clear to these providers that independent management of the ‘faster’ and ‘cheaper’ portions of the trilogy was advantageous. Independent cost and schedule data is essential for these firms to see where they can improve their construction cost base and compress their schedule. This became so successful for these multinationals in overseas markets that they brought the services back with them to their home market in the United States.

Secondly, the data center market is very competitive. The major players are always looking for a competitive advantage, or at the very least, to be sure they do not fall behind. They are always monitoring their competition and ensuring that they are maintaining best practice in the industry. Independent Schedule Management began allowing data center providers to mitigate schedule constraints and build data centers quicker. Independent Cost Management was creating significant cost savings through value engineering and greater involvement in estimating and procurement, as well as allowing for better cost forecasting, which is necessary when investing so heavily in the market. In such a competitive market, providers began to recognize the need for these services in order to avoid falling behind, and in a sector where it was not traditionally the norm, independent Cost and Schedule Management is beginning to thrive.

Independent Cost and Schedule Management in action

Clients across all construction sectors are seeing the advantages of independent oversight on their cost and schedule. Initial apprehension from clients and Project Managers quickly disappears when the cost savings and schedule insight provided by professionals, with very little vested interest, become apparent. Cost Managers often work with Project Managers to help them understand that our role can make theirs so much easier. We can take on some of their responsibilities relating to Cost and Schedule Management, and in turn allow them to concentrate on delivering a best-in-class data center.

As Cost Managers, we can show clients clear metrics which indicate our savings-to-fee ratio (averages about seven times on US data center projects or a saving on CAPEX of 10 to 15 percent). However, for major investors in the data center market, the overall construction cost is just one element of the Cost Management required. Forecasting capital expenditure is hugely important, so that clients do not have assets tied up unnecessarily. Furthermore, good Schedule Management can help foresee the probability of success in achieving the stated milestones. It can highlight potential time impacts (which can lead to costs if not mitigated), and also monitor labor productivity of GMP sub-contractors with cost and man-loaded schedules. This oversight often works hand-in-hand with cost savings when a full Project Controls structure is adopted.

Independent Cost and Schedule Management – the future?

We continue to observe major data center providers looking for areas where they can compress the delivery schedule and reduce the cost per MW, in line with their competition. Many clients do not wish to have too much speculative data center availability, and so continue to look at their data centers being more scalable and cost effective. Clients now look directly at their Schedule and Cost Management teams to help with this effort on a program level. The roles are starting to become integral to their delivery model.

The greatest marker we have for the future of independent Cost and Schedule Management in the US data center market is that we continue to see service scope increase exponentially with clients. As long as the market continues the upward trend, independent Cost and Schedule Management is likely to grow alongside it.

Since 1974, Linesight has been providing professional Cost Management services and strategic advice to major US businesses. Having overseen 155 data centers globally, and 47 in the US, we pride ourselves on our data center capabilities. Should you have any queries, please contact Gavin Flynn.